European Freight Rates Hit New Lows, Signaling a Structural Shift in Global Trade

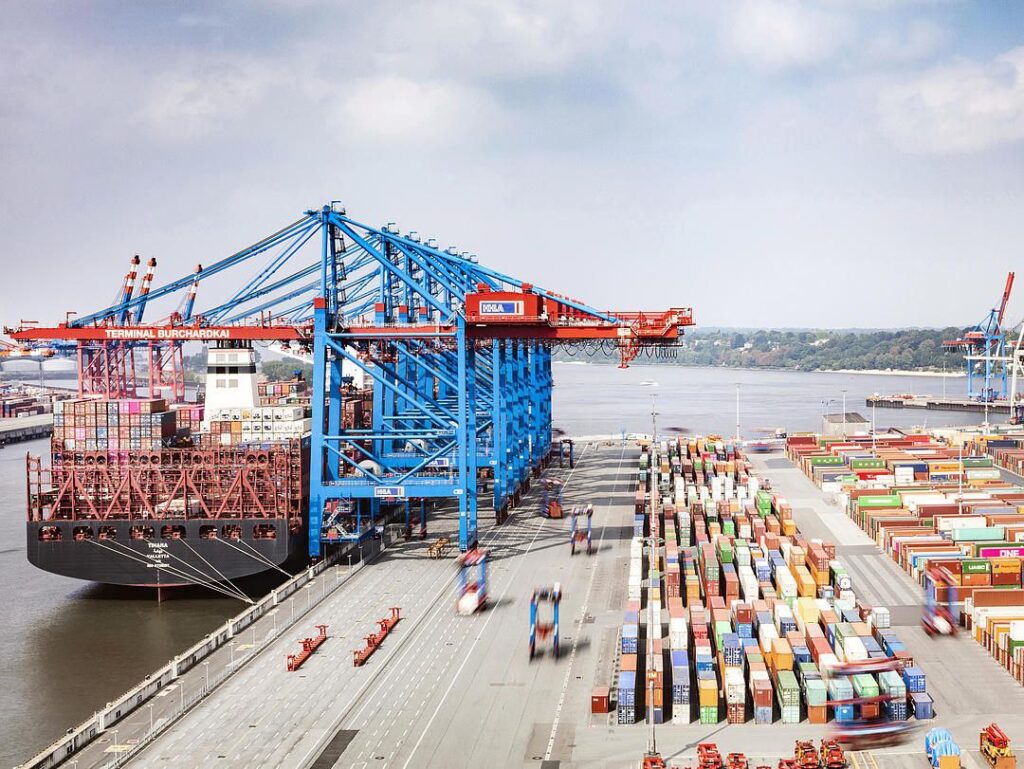

European container freight rates have now fallen to their lowest level since early 2024.

The sharp decline highlights an ongoing imbalance in the global logistics market: too many ships, too little demand, and too many uncertainties in trade flows.

Several factors are contributing to this downturn:

- A slowdown in global consumer demand, especially in Europe and North America

- Continued oversupply of vessels ordered during the post-pandemic shipping boom

- The impact of new trade tariffs and evolving geopolitical tensions

- A weaker-than-expected “peak season” that failed to lift rates

For logistics and supply chain professionals, these shifts are more than short-term volatility, they represent the start of a structural transition.

The era of relying purely on large-scale, long-distance shipping may be giving way to regionally focused and adaptive supply chains.

This transition could redefine strategies in 2025 and beyond:

- Regionalization: Building stronger local networks to reduce exposure to global shocks.

- Flexibility over Scale: Optimizing smaller, more agile operations instead of relying solely on volume.

- Data-Driven Resilience: Using predictive analytics to anticipate disruptions and adjust capacity in real time.

- Sustainability as Strategy: As rates fall, competitive advantage may shift toward greener and more efficient transport modes.

In a world of volatile demand and rising trade barriers, resilience is no longer a reactive approach, it’s a strategic necessity.

How do you see the freight market evolving over the next year?

Will Europe move toward regional logistics hubs, or will the global market rebound in 2026?