China Tightens Offshore Tax Enforcement, Putting Exporters and Global Supply Chains Under Pressure

China has significantly ramped up its offshore tax enforcement, sending shockwaves through the export sector and raising fresh concerns across global supply chains.

Chinese tax authorities are intensifying scrutiny on exporters using offshore structures to manage international transactions, targeting practices that were previously tolerated or loosely enforced. The move is part of Beijing’s broader effort to curb tax leakage, strengthen regulatory oversight, and increase fiscal transparency amid slowing economic growth. [scmp.com]

Exporters Face Rising Compliance Burden

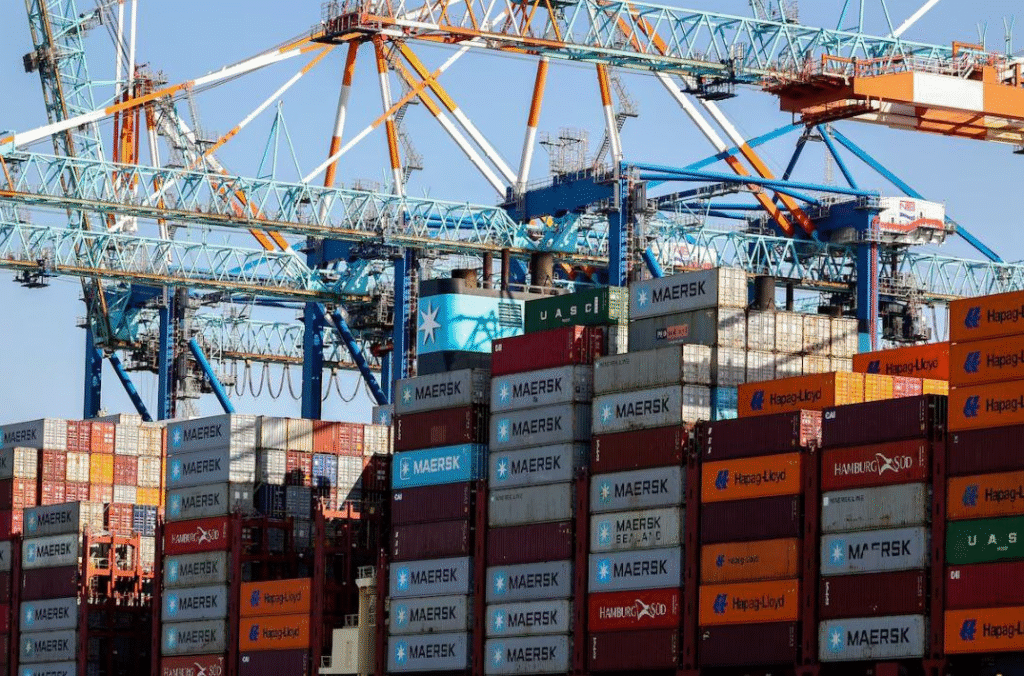

Many exporters, particularly those operating through Hong Kong or other offshore hubs, are now struggling to adapt to the rapidly evolving compliance landscape. Companies report increased documentation requirements, tighter audits, and closer examination of transfer pricing arrangements.

For small and mid-sized exporters, the situation is especially challenging. Compliance costs are rising sharply, while unclear guidance has left businesses uncertain about how to restructure operations without disrupting cash flow or delivery timelines.

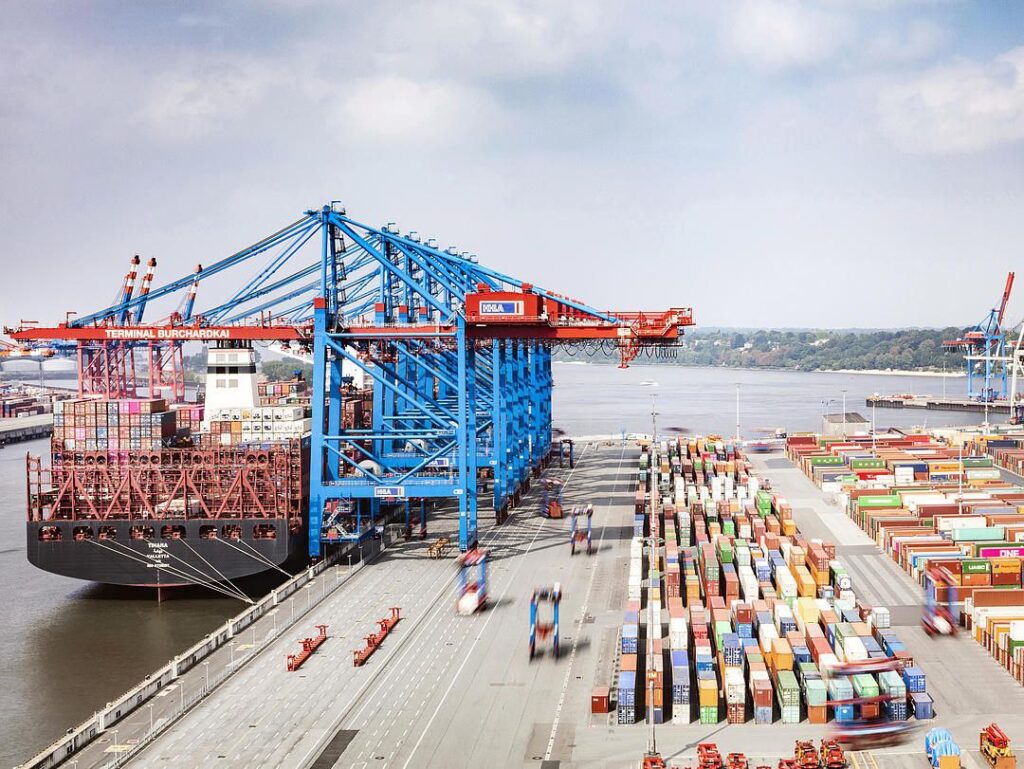

Impact on Global Trade and Logistics

The crackdown is already affecting cross-border trade efficiency. Exporters are delaying shipments, reassessing invoicing models, and renegotiating contracts with overseas buyers to manage tax exposure. Logistics providers and freight forwarders are also feeling the ripple effects, as regulatory delays and compliance checks slow cargo movement.

Industry analysts warn that prolonged uncertainty could reduce China’s export competitiveness, particularly in price-sensitive markets. Some exporters are considering relocating parts of their supply chains or shifting trading entities to alternative jurisdictions in Southeast Asia.

Strategic Shift in China’s Trade Oversight

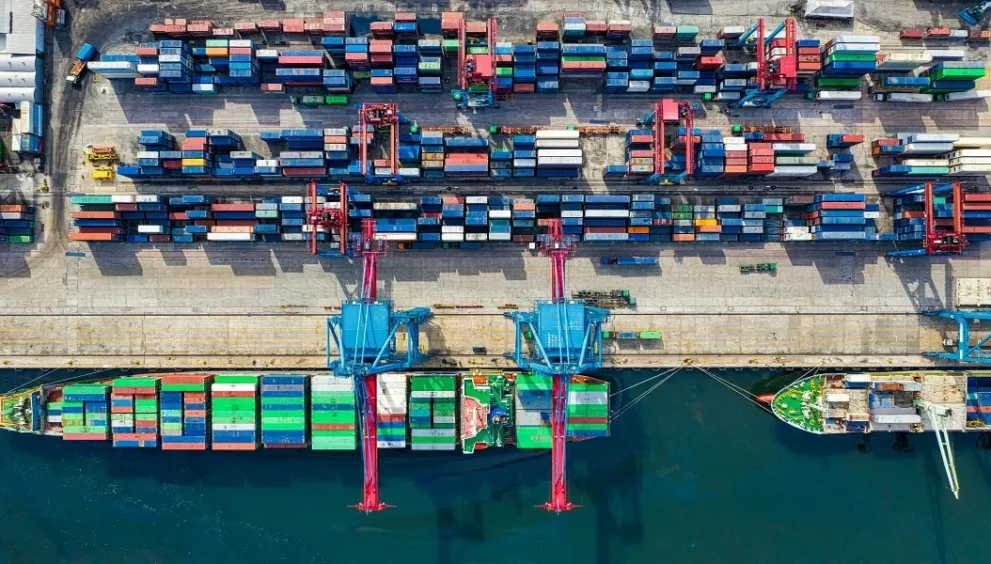

This intensified offshore tax hunt signals a structural shift rather than a short-term campaign. Authorities are leveraging data sharing, banking transparency, and international cooperation to identify mismatches between offshore income and domestic operations.

For global shippers, logistics managers, and supply chain planners, the message is clear: regulatory risk is becoming as critical as freight rates and transit times.

What Comes Next

Experts advise exporters to reassess corporate structures, strengthen tax governance, and align logistics strategies with regulatory compliance. As China continues tightening oversight, proactive adaptation may determine which exporters can maintain smooth access to international markets.