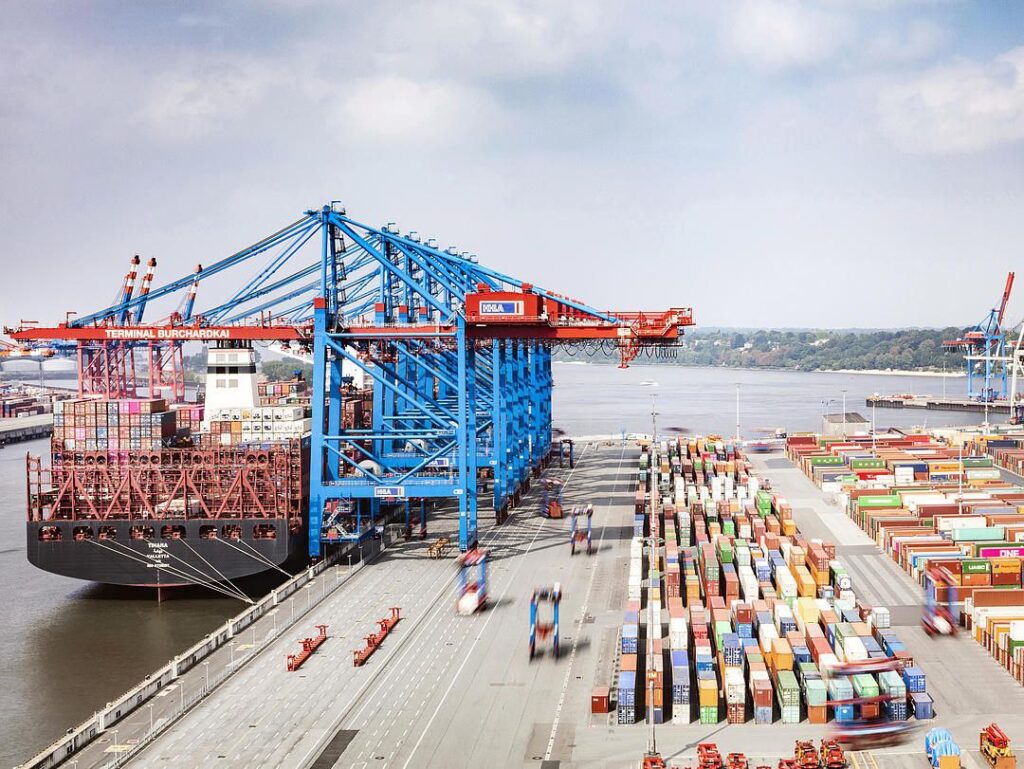

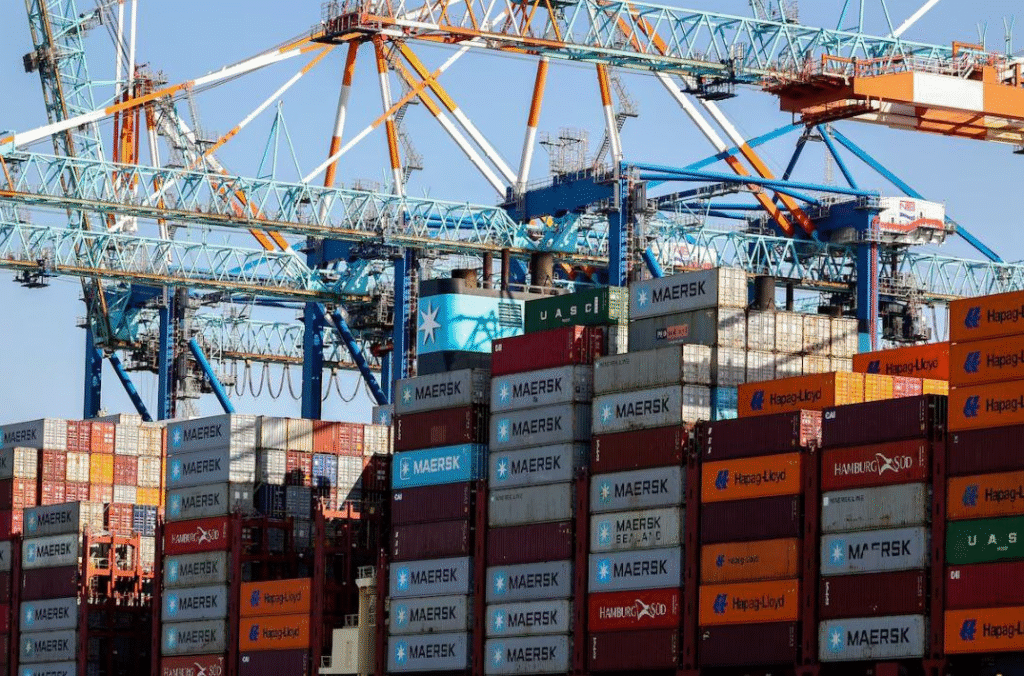

World Container Rates Fall as Lower Freight Shipments Weigh on Global Trade

Global ocean freight pricing continued to slide this week as lower freight shipments weigh on world container rates, according to the latest data from the Drewry World Container Index (WCI). The widely followed benchmark fell for a fifth consecutive week, signaling ongoing pressure on pricing across major trade lanes. [FreightWaves]

The Drewry World Container Index (WCI) fell about 1% to $1,933 per forty‑foot container (FEU), as declining demand and softer cargo volumes weighed on major trade lanes from Asia to the United States and Europe. Spot rates from Shanghai to U.S. ports like Los Angeles and New York slipped modestly, highlighting the ongoing fragility of global shipping flows. Past factors, including China–U.S. port fees, have historically influenced container rate volatility, reminding carriers of the delicate balance between supply and demand.

Industry sources say this persistent softening of freight shipments is making it tougher for carriers to maintain pricing momentum, especially as overcapacity in the market persists and average container volumes fail to rebound. Carriers are responding with more blank sailings and pricing incentives in hopes of attracting backshipments, but the supply‑demand imbalance continues to weigh on pricing.

For shippers and supply chain planners, the falling container rate environment offers short‑term cost relief, yet it also reflects broader volatility in global trade, one that may reshape contract negotiations and longer‑term freight strategies as 2026 unfolds.