U.S. Fuel Oil Imports at Risk: Venezuelan Crude Returns!

The return of Venezuelan heavy crude to international markets could significantly reduce U.S. fuel oil imports, marking a major shift in energy trade dynamics.

As U.S. refineries resume processing Venezuelan crude, they gain the ability to produce larger volumes of fuel oil domestically rather than relying on imported supplies. This change is expected to lower demand for foreign fuel oil, particularly from traditional exporting regions, and may reshape long-established trade routes.

Venezuelan crude is especially attractive to U.S. refineries because of its heavy quality, which aligns well with refinery configurations along the U.S. Gulf Coast. By increasing domestic fuel oil output, refiners can reduce import dependency while optimizing production margins. However, this shift could place pressure on global fuel oil exporters that depend on U.S. demand.

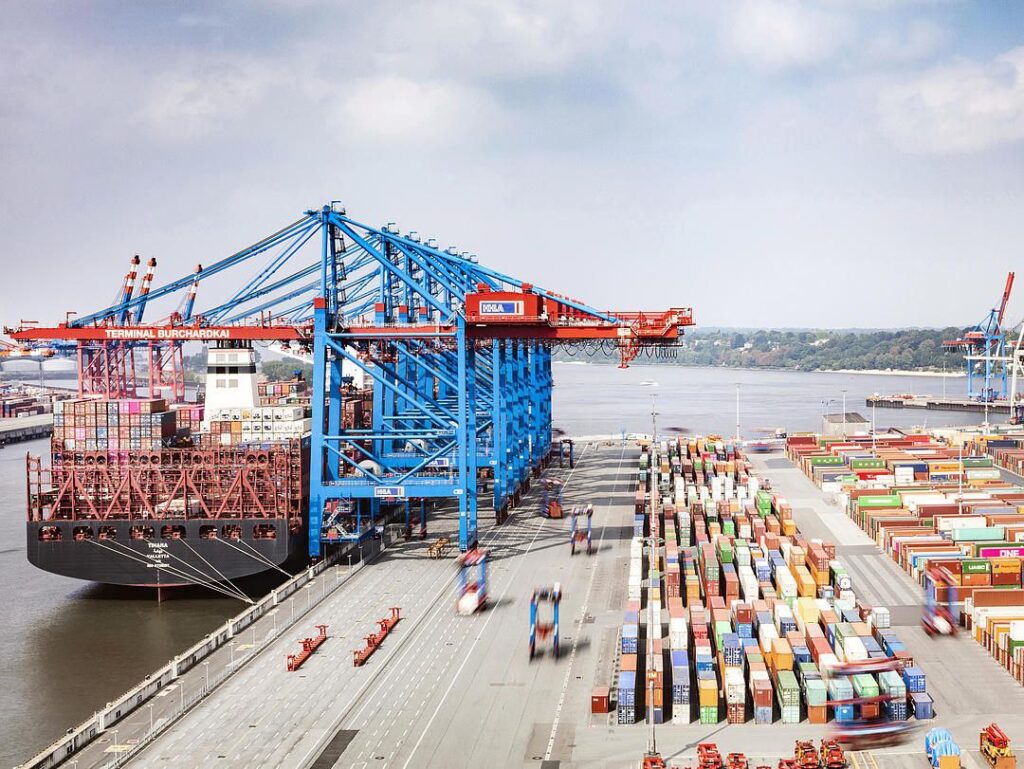

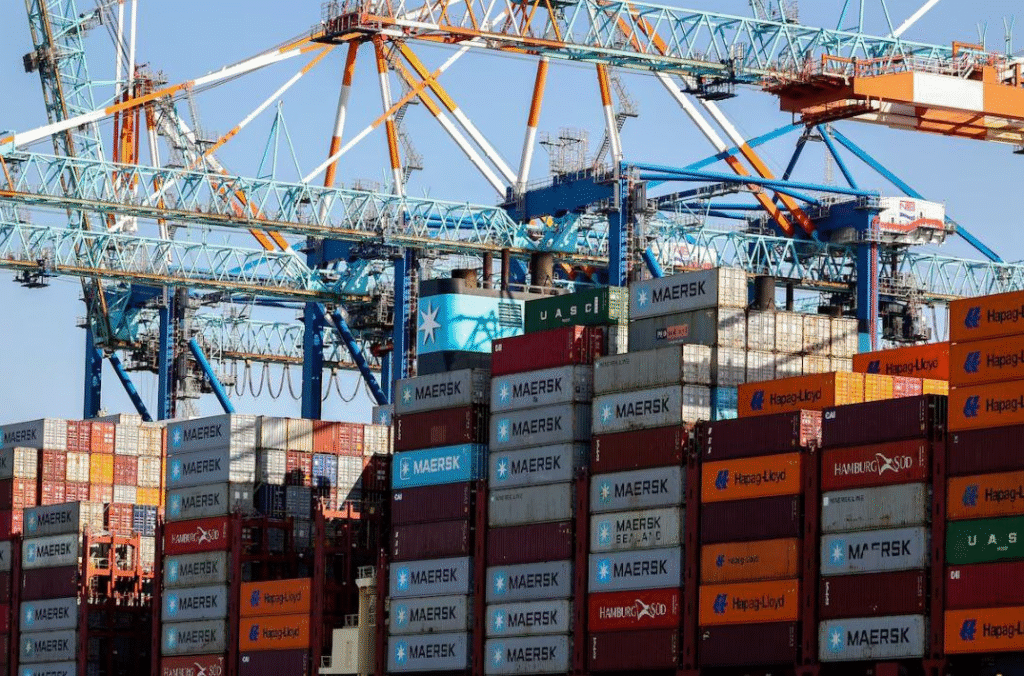

Industry analysts warn that even a modest increase in Venezuelan crude flows could have outsized consequences. Reduced U.S. imports may lead to oversupply in other markets, affecting pricing, shipping volumes, and refinery utilization rates worldwide. Changes in fuel oil demand could also influence tanker traffic patterns and regional energy balances.

The development highlights how a single change in crude supply can trigger ripple effects across global energy markets, freight movements, and supply chains. As Venezuelan oil gradually re-enters the market, stakeholders across energy, shipping, and logistics sectors will be watching closely for further disruptions.