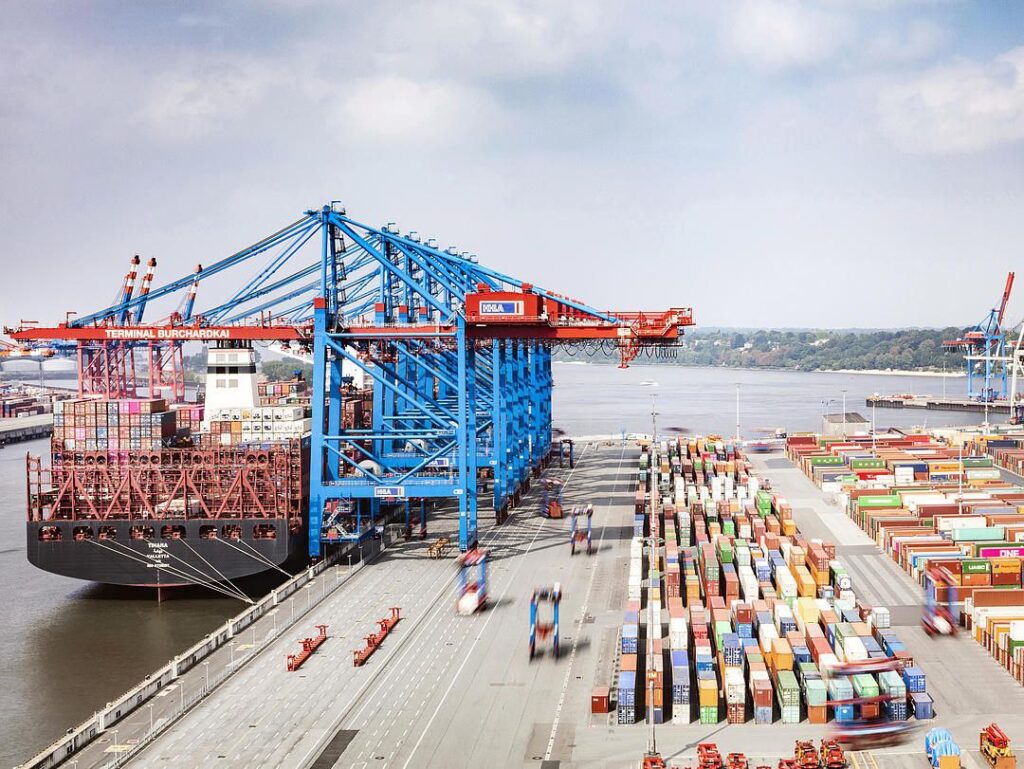

Container Shipping Industry May Face a Cyclical Downturn in 2026, Analysts Warn

The global container shipping industry is expected to enter a cyclical downturn in 2026, as vessel capacity is set to outpace demand, according to industry analysts cited by The Business Times.

Market watchers emphasize that while the sector is likely to face pressure on freight rates and profitability, the anticipated slowdown is not expected to develop into a severe crisis, but rather resemble previous cyclical corrections seen in the industry.

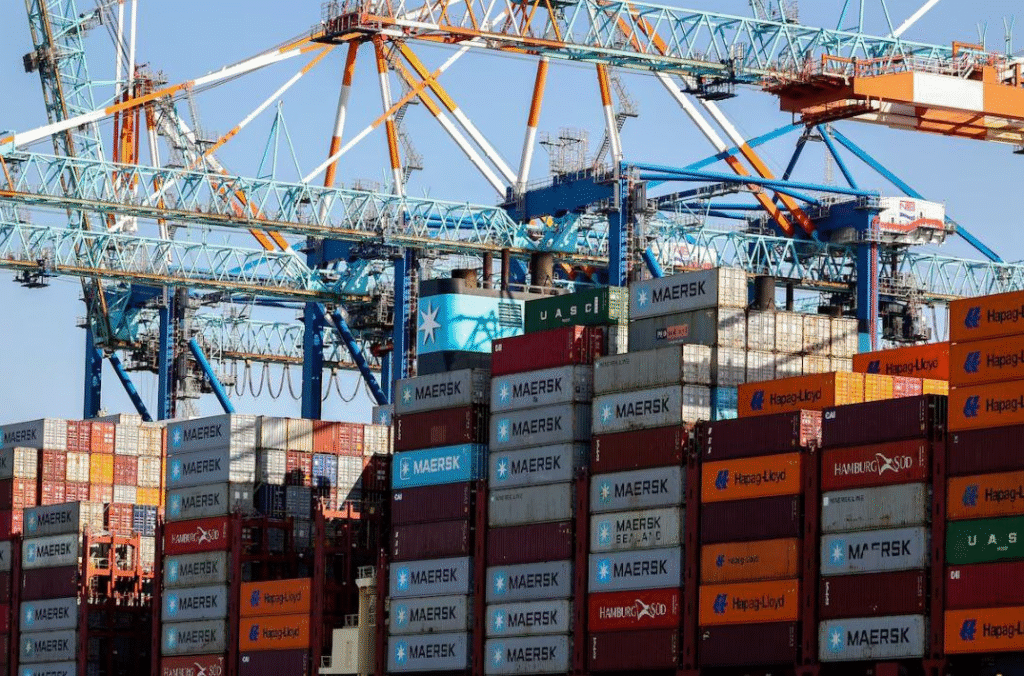

Rising Capacity Continues to Outrun Demand

A key driver behind the expected downturn is the continued delivery of new container vessels ordered during the pandemic-era boom. Analysts warn that fleet expansion is progressing faster than global cargo demand, creating an oversupply of shipping capacity.

This imbalance is likely to push freight rates lower, placing pressure on carriers’ earnings and margins, particularly as demand growth remains modest amid a fragile global economic outlook.

Suez Canal Returns Could Add Further Capacity Pressure

Another factor expected to influence market conditions is the gradual return of container ships to the Suez Canal route. While rerouting vessels back through Suez would reduce sailing times, fuel consumption, and emissions, it would also release additional effective capacity into major trade lanes.

Analysts note that this shift could intensify congestion at ports and further increase available capacity, compounding the supply-demand imbalance already facing the industry.

A Cyclical Correction, Not a Structural Collapse

Shipping analyst Lars Jensen, CEO of Vespucci Maritime, described the expected downturn as a normal cyclical phase rather than a structural breakdown of the industry. He compared the projected conditions to the 2015–2016 downturn, when excess capacity weighed heavily on freight markets but did not result in a systemic collapse.

According to Jensen and other observers, the situation differs significantly from the global financial crisis of 2008–2009, when shipping demand dropped sharply and prolonged financial stress hit carriers worldwide.

Outlook for 2026

Industry observers expect container shipping companies to face a more challenging operating environment in 2026, characterized by lower freight rates, tighter margins, and increased competition. However, strong balance sheets, disciplined capacity management, and alliance structures may help major carriers weather the downturn more effectively than in previous cycles.

While near-term pressures are likely, analysts stress that the downturn should be viewed as part of the industry’s natural cyclical rhythm, rather than a signal of long-term decline.